Unemployment income tax calculator

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

Dor Unemployment Compensation

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form. Jan 01 2021 Our income tax calculator calculates your federal state and.

Your average tax rate is 1198 and your marginal. You can include your. FUTA taxes named for the Federal Unemployment Tax Act are payments of a percentage of employees wages that.

The FUTA tax is 6 on the first 7000 of income for each employee. If you make 70000 a year living in the region of California USA you will be taxed 15111. Deduct federal income taxes which can range from 0 to 37.

You must pay federal unemployment tax based on employee wages or salaries. This Estimator is integrated with a W-4 Form. Ad File your unemployment tax return free.

41100 year salary Show more options Health insurance 4017 Public pension 3822 Unemployment insurance 493 Income tax 5752 You pay 34 14085 You keep 66 27015. Most employers receive a. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. The states SUTA wage base is 7000 per. Your employer withholds a 62 Social Security tax and a.

To report unemployment compensation on your 2021 tax return. Withholding information can be found through the IRS Publication 15-T. How to Calculate Employers Portion of Social Security.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. This Estimator is integrated with a W-4 Form. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

Estimate your tax refund with HR Blocks free income tax calculator. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income. Your household income location filing status and number of personal.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Simple tax calculator to determine if you owe or will receive a refund. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

California Income Tax Calculator 2021. If your company is required to pay into a state unemployment fund you may be eligible for a tax credit.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Missouri Income Tax Rate And Brackets H R Block

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Taxable Income H R Block

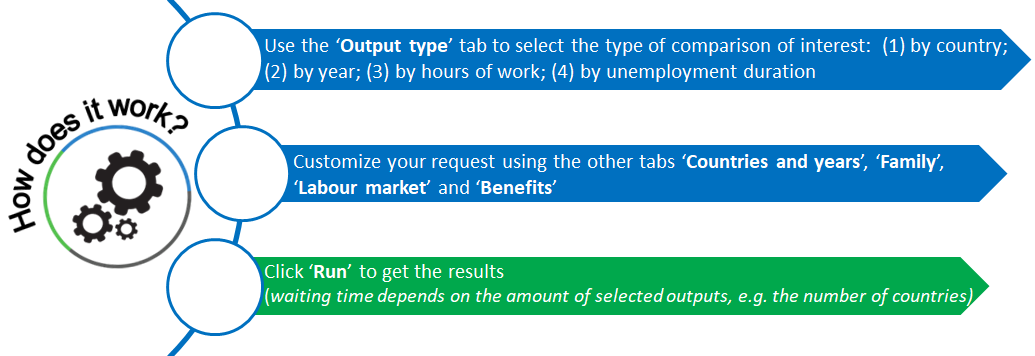

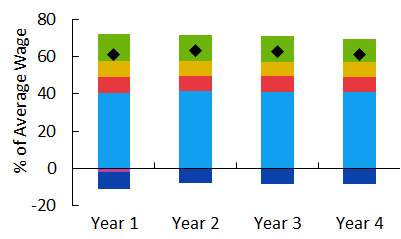

Tax Benefit Web Calculator Oecd

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

Payroll Tax Calculator For Employers Gusto

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Ontario Income Tax Calculator Wowa Ca

Federal Income Tax Calculator Atlantic Union Bank

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Credit Karma To Offer Tax Filing Through Turbotax Forbes Advisor

Income Tax Why Do We Pay Federal Income Tax H R Block

Tax Benefit Web Calculator Oecd

Ca Income Tax Calculator August 2022 Incomeaftertax Com

Tax Calculator Canada Salary After Tax